Shaped by social, economic, and political changes, health insurance has evolved dramatically since its inception. We can trace the concept of health care insurance back to ancient times when mutual aid societies provided rudimentary forms of coverage for their members. However, modern health insurance began to take shape in the late 19th and early 20th centuries.

Beginnings of Health Insurance

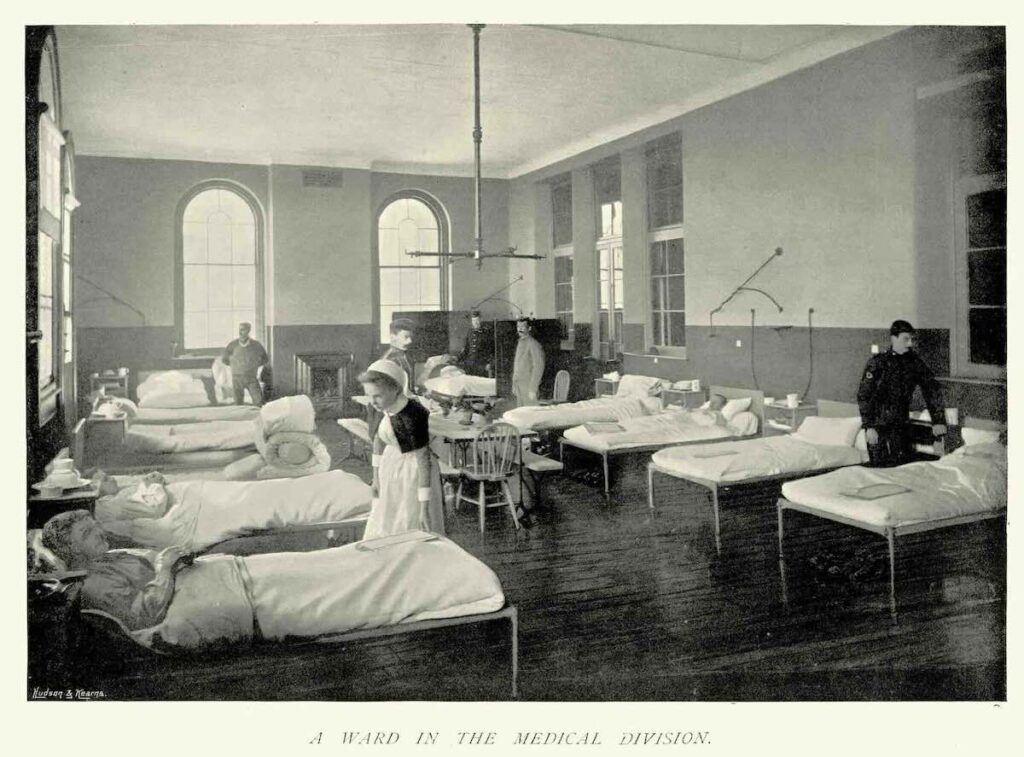

The seeds of health insurance were sown in the 19th century with the rise of “sickness funds.” These were financial associations that were often set up by employers or fraternal societies in which members pooled their resources to cover medical costs for those who fell ill. Think of it as a community-based safety net.

In 1883 the first modern health insurance system was established in Germany under Chancellor Otto von Bismarck. The Sickness Insurance Act of 1883 mandated that industrial workers be covered by health insurance, funded jointly by employers and employees.

In the U.S. the origin of health insurance lies in the establishment of Blue Cross in 1929, set up to help financially struggling patients at Baylor University Hospital in Dallas, Texas. Their plan provided teachers with 21 days of hospital care for a fixed prepaid fee, laying the groundwork for employer-based health insurance.

The Great Depression spurred the growth of employer-sponsored health insurance with companies offering health coverage to attract and retain workers.

Expansion and Regulation

During World War II wage controls influenced employers to offer health insurance as a benefit to workers. After the war rising wages and a strong economy caused employer-sponsored plans to become more widespread.

However, the issue of universal health insurance became a national debate. In 1945 then-President Truman’s proposal for government-funded health coverage faced stiff opposition and wasn’t enacted.

1965 was a pivotal year in U.S. health care history with passage of Social Security Amendments that created Medicare and Medicaid. Medicare provided health insurance for Americans aged 65 and older while Medicaid offered coverage to low-income individuals and families.

Rising Costs and Managed Care

In the 1970s to 1980s the health care industry experienced rapid cost increases, leading to the development of managed care systems. Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs) emerged as ways to control costs and manage care. The Health Maintenance Organization Act of 1973 encouraged the growth of HMOs by providing federal funds and requiring employers to offer them as an option.

Efforts to reform health care in the U.S. in the 1990s included the Clinton administration’s failed attempt to implement a comprehensive national health care plan. Despite this failure, incremental changes occurred such as the introduction of the Children’s Health Insurance Program (CHIP) in 1997, which expanded coverage to uninsured children.

Affordable Care Act and Beyond

In 2010 the Patient Protection and Affordable Care Act (ACA), commonly known as Obamacare, was signed into law by then-President Barack Obama. The ACA aimed to increase health insurance coverage, reduce costs, and improve health care quality. Key provisions included the establishment of health insurance marketplaces, expansion of Medicaid, and a mandate for individuals to have insurance or face penalties.

As of 2024, the ACA has significantly impacted health insurance coverage in the U.S. There are only about 27 million uninsured out of the total U.S. population of 279 million people in 2024 (source: The Urban Institute).

In 2022 the uninsured rate was 8.9%, lower than the 16.3% in 2010 (source: U.S. Census Bureau). 38 states and the District of Columbia (DC) have adopted Medicaid expansion, extending coverage to millions of low-income Americans.

Global Perspective

Health care systems and insurance models vary widely across the world. Many developed countries such as Canada, the U.K., and Australia have established universal health care systems funded by taxation, ensuring that all their citizens have access to medical services.

Canada’s single-payer health care system, known as Medicare, was established through the Canada Health Act of 1984. Funded by federal and provincial taxes, it provides comprehensive coverage to all Canadian residents.

Founded in 1948 in the U.K., the National Health Service (NHS) offers health care funded through taxation and provides services free at the point of use for all U.K. residents.

In 2023 about 90% of the world’s population had access to some form of health insurance or coverage (source: World Health Organization [WHO]). However, disparities remain, especially in low- and middle-income countries where out-of-pocket expenses can still lead to significant financial hardship.

Challenges and Future Directions

Despite progress, challenges remain in the health insurance landscape. In the U.S., issues persist such as rising health care costs, uninsured people, and disparities in coverage quality. Globally, achieving universal health coverage (UHC) is a top goal, with efforts focused on expanding access and reducing financial barriers.

The COVID-19 pandemic accelerated the adoption of telehealth and digital health technology solutions, which have the potential to improve access and efficiency in health care delivery. Health insurance plans are increasingly incorporating telehealth services to meet consumers’ changing needs and expectations.

Future policy developments will likely focus on addressing cost containment, improving health outcomes, and ensuring equitable access to health care. The ongoing debate over single-payer systems versus multi-payer models will shape the future of health care insurance in the U.S. as well as globally.

Conclusion

The history of health insurance reflects broader social and economic changes, evolving from simple mutual aid societies to complex, multifaceted systems. As health care needs and technologies continue to evolve, so too will health insurance models with the ultimate goal of providing accessible, affordable, and high-quality health care for all.

For more insights and innovative solutions in health insurance and health marketing, visit Innovation Direct Group.

#healthmarketing #healthinsurance #InnovationDirectGroup